An easy solution to your

legal marketing needs

eGen specializes in lead generation so that you don’t have to. We save you time and money with our customizable, data-driven marketing campaigns. With a simple solution for growing your caseload, you can focus on what matters most – your clients.

Get StartedLead Generation Services

Grow your caseload with our real-time, exclusive legal leads.

Social Security

Create custom screening packages based on your firm's needs.

Personal Injury

Receive leads including auto accident, slip and fall, and more.

Employment Law

Receive wrongful termination leads, discrimination leads and more.

Workers' Compensation

Receive leads seeking help after a workplace injury or illness.

Lead Management

Track and manage leads from anywhere with eLuminate.

About Us

$1B+

Estimated revenue generated for clients

3.9M

Legal Leads generated

1500+

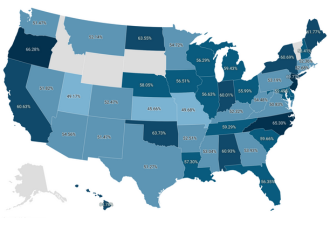

Law firms nationwide

15

Years in business

Support

Have questions? Your dedicated account manager can help.

Contact

Contact eGen to learn about pricing and availability.

Other Resources

Learn how to be successful with our lead services.

Work With eGenerationMarketing!

Every firm has different needs. Because of this, we'll create a custom lead package. Screen based on location, qualifying questions, age, and more.

Get Started